maryland ev tax credit 2020

If at least 50 of the battery components in your EV are made in the US. Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies local and county.

U S Ev Charging Incentives Rebates Chargelab

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or lease the vehicle.

. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. If your EV was made in the US with a union workforce. This program is designed to encourage the deployment of energy storage systems in the state.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. Electric Cars Eligible for the Full 7500 Tax Credit. For more information about the Maryland Energy Storage Income Tax Credit Program please visit the MEA Website or contact us at energystoragemeamarylandgov or by phone at 410 537-4000.

500 EV Tax Credit. E-Tron EV E-Tron Sportback EV E-Tron SUV EV A7 TFSI e Quattro PHEV Q5 TFSI e. Jahmai Sharp-Moore 443-694-3651.

Representative may contact me in the future regarding driving charging behavior as well as overall electric drive satisfaction. Tax credits depend on the size of the vehicle and the capacity of its battery. Applicant Signature Print Name Date Signed Signed By Applicants must attach copies of the following documents to this application failure to do so will result in an incomplete application.

Excise Tax Credit for Plug-In Electric and Fuel Cell Vehicles As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for both plug-in electric vehicles and fuel cell vehicles for Fiscal Year 2020 July 1 2019 June 30 2020 has been depleted. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. 4500 EV Tax Credit.

Baltimore MD The Maryland Energy Administration MEA has opened the application period for the Tax Year 2020 TY20 Maryland Energy Storage Income Tax Credit Program. The Clean Cars Act of 2021 HB 44 proposes to extend and increase the funding for the Maryland electric vehicle excise tax credit. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids.

Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. However its worth noting that certain restrictions apply and after a manufacturer has sold more than 200000. Some other notable changes include.

Even local businesses get a break if they qualify. The deadline to apply is January 15 2021 at 1159 PM EST. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

Annual funding would increase to as much as 26000000 through fiscal year 2023 under the proposal by Delegate David Fraser-Hidalgo. Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year before it even began on July 1 2019. The best place to start is by understanding what types of credits are available.

EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before. The tax break is also good for up to 10 company vehicles. January 1 2023 to December 31 2023.

For more general program information contact MEA by email at mikejonesmarylandgov or by phone at 410-537-4071 to speak with Mike Jones MEA Transportation Program Manager. Plug-In Electric Vehicles PEV Excise Tax Credit. MEA is now accepting applications for the Maryland Energy Storage Income Tax Credit Program for Tax Year 2020.

Maryland offers a. In total for fiscal year 2020 to 6 million an. 2020 to December 31 2022.

Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Excise Tax Credit for Plug-In Electric and Fuel Cell Vehicles As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for both plug-in electric vehicles and fuel cell vehicles for Fiscal Year 2020 July 1 2019 June 30 2020 has been depleted. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. The excise tax credit expires. Currently no funding has been authorized beyond the 6 million for Fiscal Year 2020.

Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and this amount can be up to 7500. FOR IMMEDIATE RELEASE. Maryland state legislation could increase the tax credit received for electric cars to 3000 per vehicle.

If you have questions regarding submitted applications andor their status please contact evsemeamarylandgov. If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year.

Pdf Review And Analysis Of Electric Vehicle Supply And Demand Constraints

Pdf Review And Analysis Of Electric Vehicle Supply And Demand Constraints

Appliance Rebates Southern Maryland Electric Cooperative

Pdf Review And Analysis Of Electric Vehicle Supply And Demand Constraints

Plug In Electric Vehicle Policy Center For American Progress

Plug In Electric Vehicle Policy Center For American Progress

Utilities Tesla Uber Create Us Lobbying Group For Electric Vehicle Industry

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Plug In Electric Vehicle Policy Center For American Progress

Plug In Electric Vehicle Policy Center For American Progress

Appliance Rebates Southern Maryland Electric Cooperative

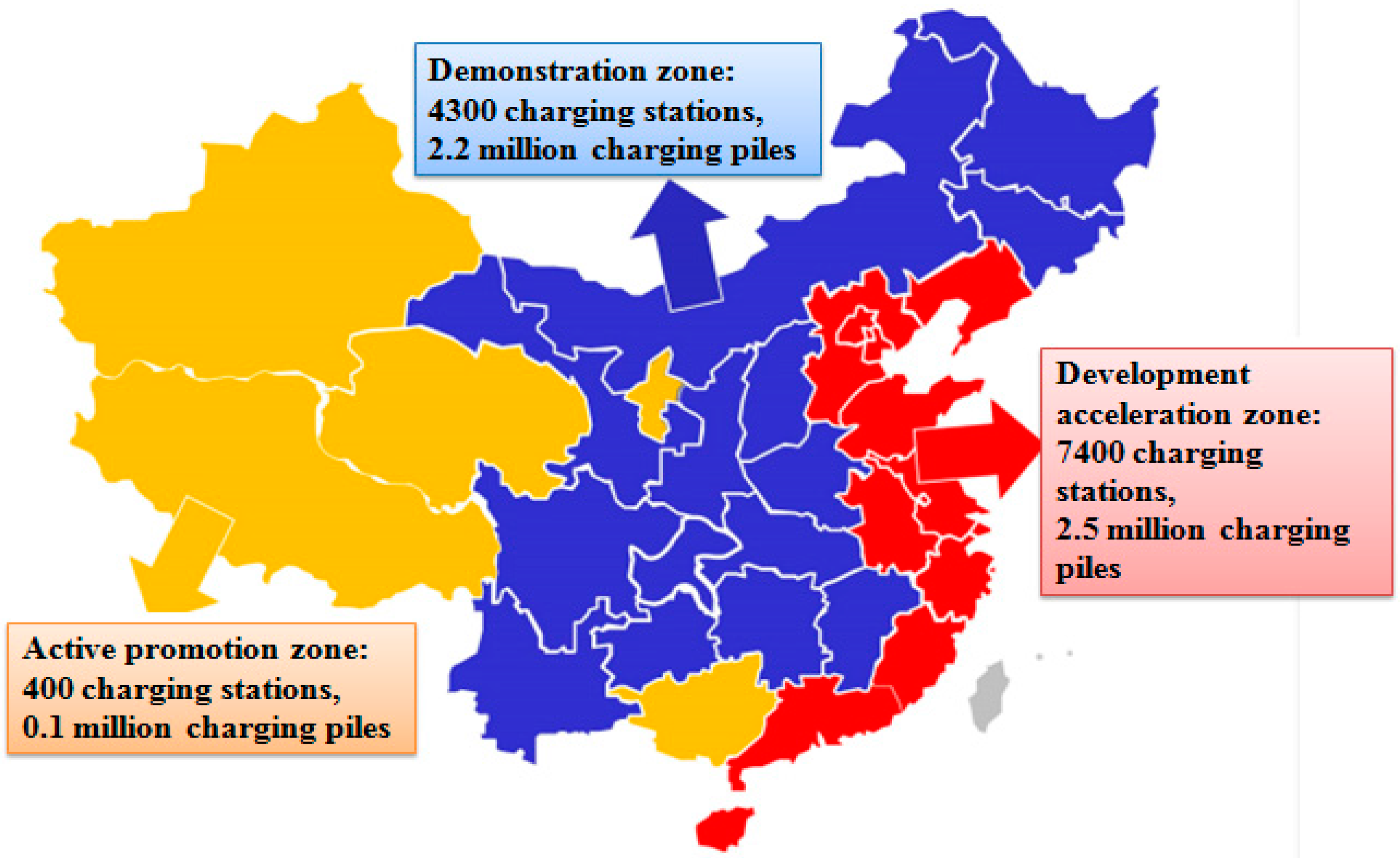

Sustainability Free Full Text Innovative Application Of The Public Private Partnership Model To The Electric Vehicle Charging Infrastructure In China Html

Plug In Electric Vehicle Policy Center For American Progress

How Ev Charging Infrastructure Growth Reflects Governments Policies

Plug In Electric Vehicle Policy Center For American Progress

Everything You Need To Know About The Solar Tax Credit Palmetto